After a car accident, most people want two things: to get their vehicle back to pre-accident condition, and to make sure their insurance covers what it should. But getting the full value from your insurance claim isn’t always automatic.At Pristine Collision Center, we’ve helped countless drivers in Hollywood, West Hollywood, Montebello, and Westminster successfully navigate the claims process. Here’s what you need to know to make sure your insurance claim works for you, not against you.

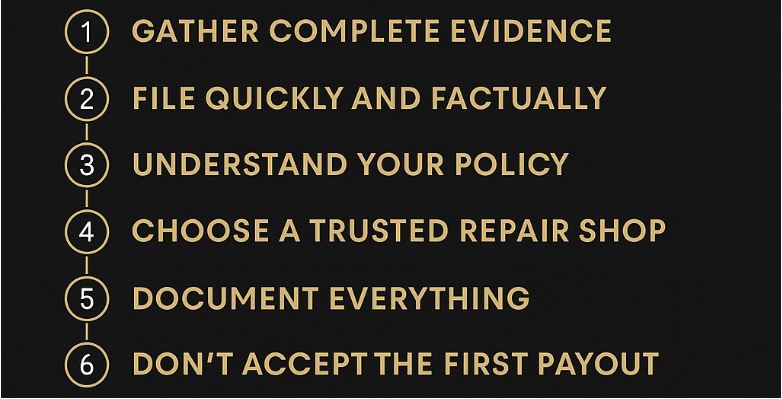

Start at the Scene: Gather Everything

OThe claim process starts long before you contact your insurance provider. Immediately after an accident, begin gathering evidence while it’s still fresh:

- Take photos of all vehicles, road signs, skid marks, and damage

- Record the date, time, and weather conditions

- Get names and insurance info from all drivers involved

- Talk to witnesses and take down their contact info

The more complete your documentation, the harder it will be for the insurer to dispute your version of events.

File Promptly and Accurately

Timing is everything. Most insurance policies require you to report an accident within 24 to 72 hours. Waiting longer could raise red flags or complicate your eligibility. When filing the claim, be honest but strategic. Stick to the facts and avoid speculation. Saying something like “I might have been speeding” or “I wasn’t paying attention” can work against you, even if you didn’t mean to admit fault.

Understand Your Policy Before You Sign Anything

Before agreeing to anything, review your insurance policy carefully. Key areas to check:

- Collision vs. Comprehensive: Which type of claim applies?

- Deductible Amounts: Know what you’ll be paying out of pocket

- OEM vs. Aftermarket Parts: Are you entitled to original manufacturer parts?

- Rental Car Coverage: Are you covered for a temporary vehicle during repairs?

If you’re unsure, contact your agent, or bring your questions to our team at Pristine Collision Center. We help our clients understand exactly what their policy does (and doesn’t) include.

Choose a Repair Shop That Works for You, Not the Insurance Company

You are not required to use the insurance company’s “preferred” shop. In California, you have the legal right to choose any licensed collision center. Why does that matter? Some insurer-recommended shops may cut corners to keep costs down. At Pristine Collision Center, we put your safety and vehicle integrity first:

- We work directly with your insurance provider

- We advocate for OEM parts and manufacturer-grade repairs

- We document all damage, including hidden structural issues

- We provide photos and supplement estimates if your insurer’s original quote was too low

Choosing a trusted shop ensures you get the repairs you deserve, not just the ones your insurer wants to pay for.

Don’t Overlook Hidden Damage

Not all damage is visible. Frame misalignment, bent suspension, cracked sensors, and electrical issues can go unnoticed unless your vehicle is inspected by experienced technicians.

When you bring your car to Pristine Collision Center, we perform a full diagnostic inspection to uncover hidden damage. Then we submit a supplemental claim with detailed documentation, ensuring your insurance provider covers what they initially missed.

Ask for a Supplement if the Estimate Is Too Low

If the insurer’s estimate doesn’t cover the full cost of proper repairs, you don’t have to accept it. We routinely help clients submit supplements to account for additional labor, parts, and damage discovered after teardown. Insurers often provide quick estimates based on surface-level photos.

Keep a Paper Trail

Throughout the process, document every interaction:

- Save emails and call logs

- Keep all estimates, receipts, and inspection reports

- Take “before and after” photos of your vehicle

This record helps protect you if the insurer tries to delay, deny, or underpay your claim.

Don’t Accept the First Payout Without Questions

Many insurance companies offer a quick settlement to close the claim fast. But fast doesn’t mean fair. If something feels off, you have the right to push back, request a re-inspection, or get a second opinion from a collision specialist.

How Pristine Collision Center Helps You Maximize Your Claim

We do more than just repair your car, we manage the entire insurance claim process to help ensure you get the best possible outcome. Here’s what we offer:

- Manufacturer-grade repairs with OEM-quality materials

- Free damage assessments

- Insurance coordination (we talk to your adjuster so you don’t have to)

- Expert documentation for supplements and hidden damage

Four convenient Southern California locations: Hollywood, West Hollywood, Montebello, and Westminster

Let us take the hassle off your hands so you can focus on getting back on the road.

FAQ

Yes. In California, you have the legal right to choose any licensed repair shop. Insurance companies cannot force you to use their preferred providers, and you won’t be penalized for making your own decision.

Gather thorough documentation, file quickly, get a full inspection, and question low estimates. Work with a shop like Pristine collision center that submits supplements, uses OEM parts, and ensures your insurer pays what the damage truly costs.

A supplement is a request for additional payment when hidden damage is found after repairs begin. It includes updated estimates and photos. Shops like Pristine collision center handle this process to make sure your coverage is complete.

Yes. We communicate directly with your insurance company, provide all documentation, and submit supplements if needed. Our goal is to make the claims process smooth while ensuring your vehicle gets fully restored to pre-accident condition.

No. In fact, trusted shops like Pristine collision center often move things faster. We handle communication with your adjuster, prevent missed details, and avoid shortcuts, saving you time, stress, and repeat repairs down the road.