After a car accident, your first priority should be to ensure safety for all parties involved. If you’re able to, move your vehicle to a safe location, such as the side of the road or a sidewalk, to prevent further incidents and protect everyone at the scene. The steps taken in the first hour can affect repair quality, liability clarity, and long-term vehicle safety. Calling insurance too early—before documentation or professional context—can limit your options later.

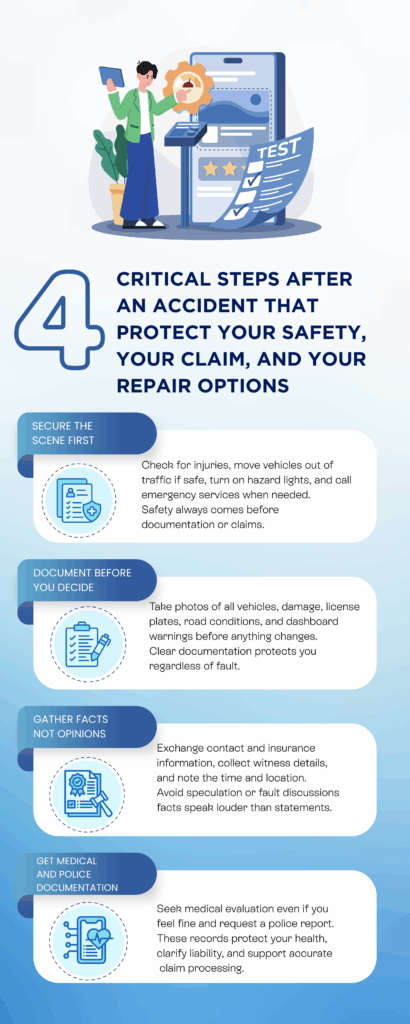

- Check for injuries and call emergency services if needed.

- Turn on your hazard lights to alert other drivers and help ensure safety at the scene.

- Take photos of the accident scene and vehicle damage.

- Gather witness statements if possible.

Why the First Hour After a Car Accident Matters

The first hour after an accident is when facts exist and flexibility is highest.

Once that hour passes:

- Vehicles are moved or towed

- Evidence disappears

- Statements are recorded

- Repair pathways begin forming

- Record the contact details of all drivers, witnesses, and police officers present at the scene, including names, phone numbers, and insurance information

This is not about delaying responsibility. It’s about avoiding irreversible decisions made under stress.

What you say, document, or agree to early often becomes the foundation for everything that follows, especially once insurance is involved.

Be sure to keep a file with all important documents related to the accident, including the contact details and information collected at the scene.

Calling the Police and Reporting the Incident

After a car accident, contacting the police is a critical step for your safety and for protecting your interests during the insurance claims process. When you call the police, provide clear details about the accident location, time, and a brief description of what happened. Responding officers will secure the scene, ensure everyone’s safety, and create an official accident report.

This police report is a key document for your car insurance claim. Your insurance company and insurance adjuster will rely on the accident report to verify facts, determine fault, and process your claim efficiently. Be sure to ask the police how to obtain a copy of the report, as your insurance provider will likely require it when you file a claim with your insurance. The police report also helps clarify the circumstances for all parties involved, reducing disputes and supporting a fair claims process.

Remember, even if the accident seems minor, having an official police report can make a significant difference in how your insurance company handles your claim and in protecting your legal rights.

Seeking Medical Attention and Documenting Expenses

No matter how you feel immediately after a car accident, seeking medical attention should be a top priority. Some injuries, such as whiplash, concussions, or internal trauma, may not show symptoms right away. A prompt medical evaluation ensures that any hidden injuries are identified and treated early, protecting your health and supporting your insurance claim.

Keep detailed records of all medical attention you receive, including doctor visits, hospital stays, prescriptions, and any recommended treatments. Save every bill, receipt, and medical report related to your accident. These documents are essential when filing a car insurance claim, as they provide proof of your medical expenses and the impact of the accident on your well-being.

Even if you feel fine, documenting your medical care creates a clear record for your insurance claim and helps ensure you receive the compensation you deserve for any injuries or medical costs resulting from the accident.

What Information Should You Collect at the Accident Scene?

After a car accident, you should collect photos of all vehicles, license plates, damage angles, road conditions, any warning lights inside the vehicle, and any visible injuries. You should also gather driver information, insurance details, driver’s license numbers, license plate numbers, witness contacts, and note the time and conditions of the accident.

Documentation protects you regardless of fault.

You should photograph:

- All vehicles involved (wide and close-up shots)

- License plates

- Damage from multiple angles

- Interior dashboard warnings or alerts

- Road layout, intersections, signage, and lane markings

- Weather, lighting, and traffic conditions

- Visible injuries

Also collect:

- Driver names and contact information

- Driver’s license numbers

- Insurance information from all drivers involved

- License plate numbers

- Witness names and phone numbers

Collecting the contact details of witnesses can provide valuable statements if disputes arise later.

Avoid commentary or conclusions. Photos and facts speak for themselves.

Once the scene changes, documentation becomes the only neutral reference point.

It is essential to exchange information with all drivers involved, including insurance information, driver’s license, and license plate numbers, to ensure accurate claim processing and legal documentation.

Understanding Legal Liability

Legal liability determines who is responsible for damages and injuries after a car accident. Understanding your potential liability is crucial for protecting your rights and ensuring a fair outcome in the insurance claim process. If you are unsure about who is at fault or if there are disputes about the accident, it’s wise to seek legal advice from an experienced attorney.

An attorney can help you interpret the police report, gather witness statements, and communicate effectively with your insurance company. Keeping thorough records—including the accident report, correspondence with your insurance provider, and any legal documents—will support your position if questions about legal liability arise.

By understanding legal liability and seeking professional guidance when needed, you can navigate the aftermath of a car accident with confidence and protect yourself from unexpected legal or financial consequences.

Should You Call Insurance Immediately After an Accident?

You are not required to call insurance immediately after a car accident unless there are injuries, law enforcement requires it, or your policy explicitly states otherwise. Taking time to document the scene and understand your situation first often leads to better outcomes.

This is where many people unintentionally give up control.

Insurance companies are efficient. They open claims quickly, record statements early, and route repairs fast. That efficiency benefits the system—but not always the vehicle owner.

Calling immediately can:

- Lock in a recorded statement before you’ve processed the event

- Trigger default repair pathways you didn’t choose

- Influence how damage is categorized before a professional evaluation

However, you should notify your own insurance company or agent as soon as possible after an accident. Be prepared to provide your policy number and detailed information about the accident, as your agent or insurance company will need these details to process your claim and verify your coverage.

Pausing does not mean avoiding insurance. It means entering the process informed.

Can Waiting to Call Insurance Hurt Your Claim?

In most cases, waiting briefly to call insurance does not hurt your claim. What causes more problems is incomplete documentation, rushed statements, or misunderstandings made under stress.

Short delays—used to document and understand the situation—rarely cause issues.

Problems arise when:

- Facts are unclear

- Statements are made emotionally

- Damage is underestimated

- Repairs begin before proper evaluation

Clarity protects claims better than speed.

Understanding Your Rights Before a Claim Is Opened

Before insurance enters the picture, vehicle owners retain important rights.

You have the right to:

- Choose where your vehicle is repaired

- Decline insurer-directed repair facilities

- Seek professional guidance before committing to a repair path

Your insurance policy is a key document that outlines your coverage, claim procedures, and what is included or excluded after an accident. If there is a dispute over the value of your vehicle or the settlement amount, your insurance policy may include an appraisal provision. This allows both you and your insurer to each select a competent appraiser to independently evaluate the damage or loss. If the appraisers cannot agree, a neutral umpire can be appointed to help determine the fair amount owed, providing an alternative to litigation.

If there are significant injuries or disputes regarding liability, consult a personal injury attorney to protect your rights and interests.

An insurance estimate is not a repair plan. It is an initial financial assessment. Proper repairs—especially on modern vehicles—often require deeper inspection and manufacturer-specific procedures.

Understanding this distinction early prevents frustration later.

Is It Safe to Drive Your Car After an Accident?

It is not always safe to drive a car after an accident, even if the damage looks minor. Modern vehicles can have hidden structural, electronic, or safety system damage that requires professional evaluation.

Vehicles today are systems—mechanical, electronic, and software-driven.

After an accident, issues may exist in:

- Steering or suspension components

- Structural attachment points

- Sensors hidden behind bumpers or glass

- Advanced driver-assistance systems (ADAS)

A vehicle may move but still be unsafe.

Professional evaluation matters—not guesswork.

If your car is not drivable, request roadside assistance and consider rental car options provided by your insurance policy to help you get back on the road safely.

Why Modern Vehicles Require Professional Repair Evaluation

Today’s cars are not repaired the way cars were even ten years ago.

Collision repair now involves: structural and auto frame repair

- Manufacturer-specific procedures

- Electronic diagnostics

- Calibration of cameras, radar, and sensors

- Structural measurements measured in millimeters

After an accident, a competent appraiser or insurance adjuster will inspect your vehicle for damage, and repair costs are assessed and documented as part of the insurance claim process. If your vehicle is declared a total loss, you may be reimbursed for repairs already made or for your vehicle’s actual cash value, depending on your coverage. During the repair process, further damage may be discovered, which will require additional assessment and approval from your insurance company before repairs can continue. Repairs may involve the use of after market parts, which are alternatives to original equipment manufacturer (OEM) parts; their quality, safety, and compatibility should be carefully considered.

Improper repairs don’t just affect appearance—they affect how the vehicle behaves in future emergencies.

OEM-certified repair standards exist for a reason: vehicles must be restored to engineered performance, not approximated.

Trust & Authority: Why Repair Process Matters More Than Speed

High-quality collision repair is a process, not a race.

After an accident, you have the option to have your vehicle repaired at a certified or preferred repair shop. Insurance may cover repairs if you obtain estimates from trusted repair shops, helping ensure all necessary repairs are paid for. If your vehicle is deemed repairable, the insurance company may include the repair facility as a payee on the claim check.

Proper repair environments prioritize:

- Manufacturer repair protocols

- ADAS calibration capability

- Documentation and transparency

- Consistent communication

Multi-location, OEM-certified operations are structured for consistency—not shortcuts. That consistency protects safety, resale value, and long-term performance.

Speed without accuracy creates risk.

Common Mistakes People Make After a Car Accident

Some mistakes are common—and avoidable.

- Assuming insurance handles repair quality

- Accepting the first repair direction offered

- Treating cosmetic damage as complete damage

- Prioritizing speed over correctness

- Avoid discussing fault with the other driver at the scene

Most post-repair issues don’t start during repairs. They start during early decisions.

When These Decisions Matter Most

Immediately After the Accident

This is when documentation is strongest and options are widest.

During the First Insurance Call

Statements and repair direction often become fixed here.

Before Repairs Begin

Once repairs start, correcting mistakes becomes difficult and expensive.

Early clarity prevents downstream problems.

Staying Prepared for Accidents

Preparation is key to handling a car accident smoothly and minimizing stress during the claims process. Keep essential documents—such as your insurance card, vehicle registration, and driver’s license—readily accessible in your car. It’s also helpful to have a list of emergency contacts, including your insurance agent and a trusted local repair shop, stored in your vehicle or phone.

Consider keeping a camera or smartphone handy to document the accident scene, vehicle damage, and any relevant road conditions. Maintaining a record of your vehicle’s maintenance and repair history can also be valuable if questions arise about the cause of the accident or the extent of vehicle damage.

By staying organized and prepared, you’ll be able to respond quickly and effectively after a car accident, ensuring a smoother claims process and better outcomes with your insurance company.

FAQ: What People Ask After a Car Accident

Do I have to call insurance immediately after a car accident?

No. Unless required by law enforcement or your policy, you can document and assess first.

Can delaying an insurance call hurt my claim?

In most cases, no. Poor documentation causes more issues than short delays.

Should I get my car inspected before calling insurance?

Yes. Understanding potential damage helps protect your repair outcome.

Can I choose my own repair shop?

Yes. Vehicle owners have the legal right to select their repair facility.

Is it okay to drive after an accident?

Only if a professional confirms it’s safe.

What’s the biggest mistake people make?

Giving up control before understanding the repair process.