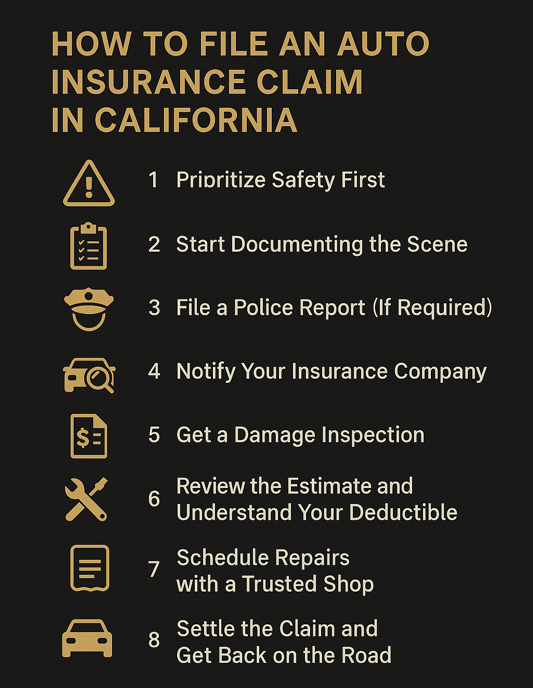

Filing an auto insurance claim after a crash can feel overwhelming, especially when you’re still shaken up or dealing with vehicle damage. Whether you’ve been in a fender bender or a more serious collision, knowing what to do, and when, can make a big difference in how smoothly the claims process goes. This guide breaks down each step to help drivers in West Hollywood, Hollywood, and across California handle a car insurance claim with confidence.

Step 1: Prioritize Safety First

Immediately after an accident, your first concern should be the well-being of everyone involved. If possible, move your vehicle out of traffic to a safe location and turn on your hazard lights. Check for injuries, both in your car and others, and call 911 if anyone is hurt or if there’s significant vehicle damage. Even if everyone seems okay, it’s still smart to get checked by a medical professional, as injuries like whiplash or internal bruising can show up hours later.

Step 2: Start Documenting the Scene

Once everyone is safe and emergency services are on the way (or not needed), take time to document everything. Your phone is your best tool here, snap photos of the damage from multiple angles, license plates, traffic signs, road conditions, and anything else that helps tell the story of what happened. Collect names, insurance details, and phone numbers from the other driver(s) and try to speak to any witnesses while they’re still present. Their perspective may be crucial later.

Step 3: File a Police Report (If Required)

Not every accident requires a police report, but in California, one is legally required if there are injuries, fatalities, or property damage exceeding $1,000. Even if it’s a minor crash, getting an official report can help you later, especially if liability is unclear. Be honest, stick to the facts, and ask the responding officer how to obtain a copy of the report for your records and insurance provider.

Step 4: Notify Your Insurance Company

Contact your insurance company as soon as possible, preferably within 24 to 72 hours after the accident. Most companies allow you to file a claim online, through their app, or by calling a representative. Be prepared to provide details about the crash, including the date, location, what happened, who was involved, and any police report or witness information. Photos and videos you took at the scene can help expedite the claim.

If you’re unsure whether your claim falls under collision, comprehensive, or another category, your insurer can explain how your coverage applies.

Step 5: Get a Damage Inspection

Once your claim is filed, the insurance company may send an adjuster to inspect your vehicle or ask you to visit an approved inspection center. However, California law gives you the right to choose your own repair shop. This means you’re not required to use your insurer’s “preferred” provider.

At Pristine Collision Center, we offer certified damage assessments and communicate directly with insurers to speed up the process. If hidden damage is discovered after the initial estimate, we handle re-inspections and documentation so your claim reflects the true cost of repairs.

Step 6: Review the Estimate and Understand Your Deductible

After the inspection, your insurer will provide a repair estimate. Take time to review it carefully. Are they using OEM (original equipment manufacturer) parts or aftermarket components? Are all visible and underlying damages included? Clarify whether rental car coverage is included and confirm how much your deductible is.

If something seems off or incomplete, you’re allowed to seek a second opinion, and shops like ours can help with that. It’s important to advocate for the full scope of repairs your policy covers.

Step 7: Schedule Repairs with a Trusted Shop

Once the claim is approved, you can begin repairs. This is where choosing the right repair shop matters. At Pristine Collision Center, we specialize in high-quality work using OEM-grade parts and advanced tools. Our team is experienced in everything from structural collision repair to aluminum and carbon fiber bodywork. We also handle glass replacement and paintless dent repair, so you don’t have to juggle multiple vendors.

Best of all, we work directly with your insurance provider, saving you time and frustration.

Step 8: Settle the Claim and Get Back on the Road

After repairs are completed, you’ll pay your deductible and the insurer will handle the rest of the payment directly with the shop. Keep copies of all invoices, estimates, and communications for your records. If your vehicle was declared a total loss, the insurer will offer a payout based on the market value. You always have the right to review and negotiate the settlement if needed.

Know Your Rights as a California Driver

Many drivers don’t realize they have more control than the insurance company suggests. You’re legally allowed to choose your own repair facility, request OEM parts (depending on your policy), and challenge low estimates. Don’t let anyone pressure you into quick decisions that compromise the safety or value of your vehicle.

Need Help with Your Claim?

If you’ve been in a collision, let the experts at Pristine Collision Center walk you through the insurance claim process. We offer full-service repairs, direct communication with your provider, and peace of mind knowing your car is in good hands. Proudly serving Hollywood and West Hollywood, we’re here to help when it matters most.

Not always, but it’s highly recommended. It adds credibility and detail to your case.

Yes, especially in hit-and-run or uninsured driver scenarios. A police report becomes even more important in these cases.

As soon as possible, ideally within 24 to 72 hours. Waiting too long can lead to delays or even denial of your claim.

It might, depending on who was at fault, your claim history, and your insurer’s guidelines. Your agent can give you a clearer answer based on your situation.

No. In California, you have the right to choose any licensed repair shop. Pristine Collision Center works with all major insurers.